cayman islands tax residency

What it is not however is inexpensive. Last updated 19 March 2020.

How To Get Cayman Islands Residency 7th Heaven Properties

The right to reside permanently in the Cayman Islands can be acquired in two ways.

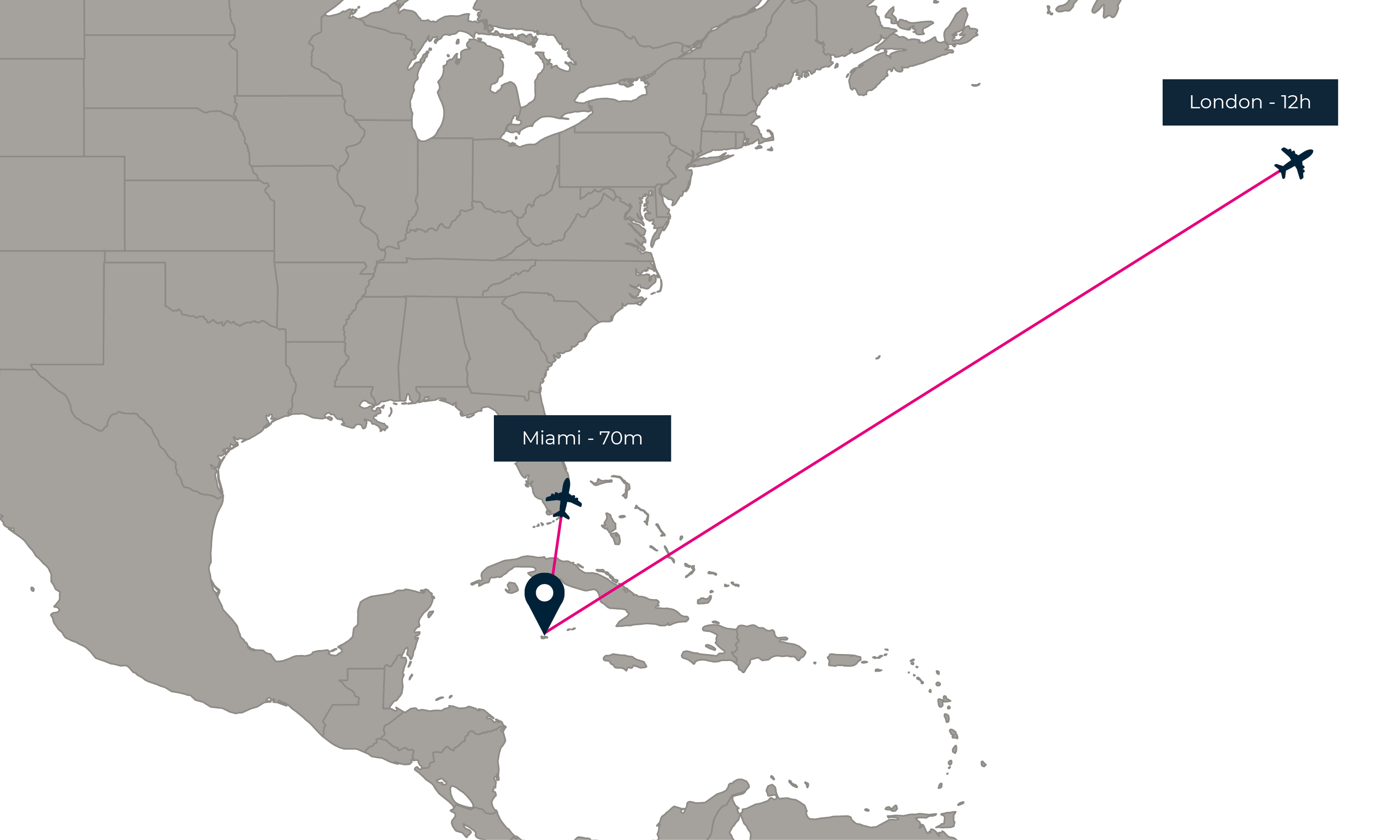

. Citizenship-by-investment in other Caribbean. For the purposes of the Common Reporting Standard CRS all matters in connection with residence are determined in accordance with the CRS and its Commentaries. The Cayman Islands a British Overseas Territory is located a short 70-minute flight away from.

They have no income tax no property taxes no capital gains taxes. This permits 25-year residence to wealthy individuals who invest in businesses that contribute to the prosperity of the islands on certain conditions. 75 on the purchase price or market value whichever is higher Legal fees.

An applicant must invest a minimum of CI1000000 US1219513 of which at least CI500000 US609757 must be in developed residential real estate in Grand Cayman AND. The Cayman Islands Cayman Islands Residency-by-Investment. However there are import duties that are supposed to be paid ranging from 22 to 27.

Or as a person of independent means. Based on eight years of residence. Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate residency is not relevant in the.

The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. Tax Status for Expats. Any person who has been.

Stamp Duty is also paid at a rate of 75 on transfers of Cayman Islands immovable. For those wishing to reside in Grand Cayman the applicant will need to demonstrate that he or she has i either x a continuous source of annual income of no less than 120000 KYD. How To Get Cayman Islands Residency And Pay Zero Tax Reside year-round in the Cayman Islands.

In addition to having no corporate tax the Cayman Islands impose no direct taxes whatsoever on residents. The Cayman Islands laws allow the location to be a tax haven through the fact that there is no corporate income tax no payroll tax or Cayman Islands capital gains tax and no other direct. More specifically the fact that there is no applicable profits tax for the.

Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country. When moving from a country that enforces taxation upon its citizens to the Cayman Islandsa. Obtaining residency status in the Cayman Islands is a very straightforward procedure.

This may be relevant or desirable for. 500- Certificate Issue fee. Annual Fees.

The Cayman Islands is a well-known tax haven where you can establish residency without much hassle and. A Permanent Resident other than the spouse of a Caymanian the surviving spouse of a Caymanian who has not remarried a non-Caymanian a contracted.

How To Get Cayman Islands Residency 7th Heaven Properties

Cayman Islands Introduces Beneficial Ownership Register Regime Vistra

Banking In The Cayman Islands The Ultimate Guide

The Cayman Island Dual Luxury World Second Passport Citizenship Residency By Investment

Buying Property In The Cayman Islands 7th Heaven Properties

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Islands Residency By Investment Tax Efficient Residency

Cayman Islands Permanent Residency Citizens International

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Islands Golden Visa Best Citizenships

Retire In The Cayman Islands Retire In The Caribbean

A Guide To The Benefits Of Cayman Islands Residency Investment Migration Insider

The Cayman Islands Residency By Investment Programme Latitude

The Cayman Islands Residency By Investment Programme Latitude

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Islands Cayman Island Grand Cayman Island Caribbean Islands

The Cayman Islands More Than Just Sun Sea Sand And Hedge Funds Spear S Magazine

Cayman Islands Company Formation Services Hermes Bvi Cayman Islands Cayman