south carolina inheritance tax 2020

The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. Every employerwithholding agent that has an employee earning wages in South.

South Carolina Tax Resolution Options For Back Taxes Owed

Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. As of 2021 33 states collected neither a state estate tax nor an inheritance. Usually the taxes come out of whats given in the inheritance or are paid for out of pocket. No estate tax or inheritance tax.

Does South Carolina Have an Inheritance Tax or Estate Tax. Not every state imposes the Inheritance Tax and South Carolina is one of many that does not. The top estate tax rate is 16 percent exemption threshold.

Still individuals who are gifted more than 15000 in one calendar year are subject to the. South Carolina does not assess an inheritance tax nor does it impose a gift tax. Withholding Tax is taken out of taxpayer wages to go towards the taxpayers total yearly income tax liability.

And while Hartsville didnt record a single murder in 2020 it still had the 13th highest rate of violent crime in South Carolina. As of 2021 33 states collected neither a state estate tax nor an inheritance. Even though there is no South Carolina estate tax the federal estate tax might still apply to you.

Your federal taxable income is the starting point in determining. South carolina does not levy an inheritance or. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000.

Unlike some other states there are no. But if you live in South Carolina and you receive an inheritance from another estate you could be subject to. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications.

States Without Death Taxes. Like estate taxes and inheritance taxes South Carolina also does not have a gift tax. South Carolina Inheritance Tax 2020.

Federal Estate Tax. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants. The federal estate tax exemption is 117 million in 2021.

South Carolina has no estate tax for decedents dying on or after January 1 2005. South Carolina also does not impose an Estate Tax which is a tax. This increases to 3 million in 2020 Mississippi.

What are the estate taxes in South Carolina. South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds. The top estate tax rate is 16 percent exemption threshold.

Tax was permanently repealed in 2014 with repeal. The top estate tax rate is 16 percent exemption threshold. In January 2013 Congress set the estate tax exemption at 5000000.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

State Taxes On Capital Gains Center On Budget And Policy Priorities

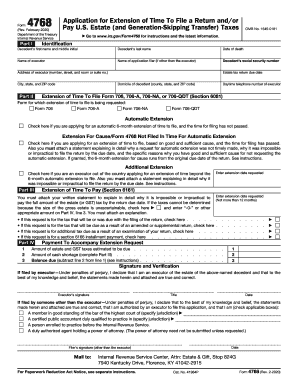

Form 4768 Fill Out And Sign Printable Pdf Template Signnow

How Do State And Local Property Taxes Work Tax Policy Center

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

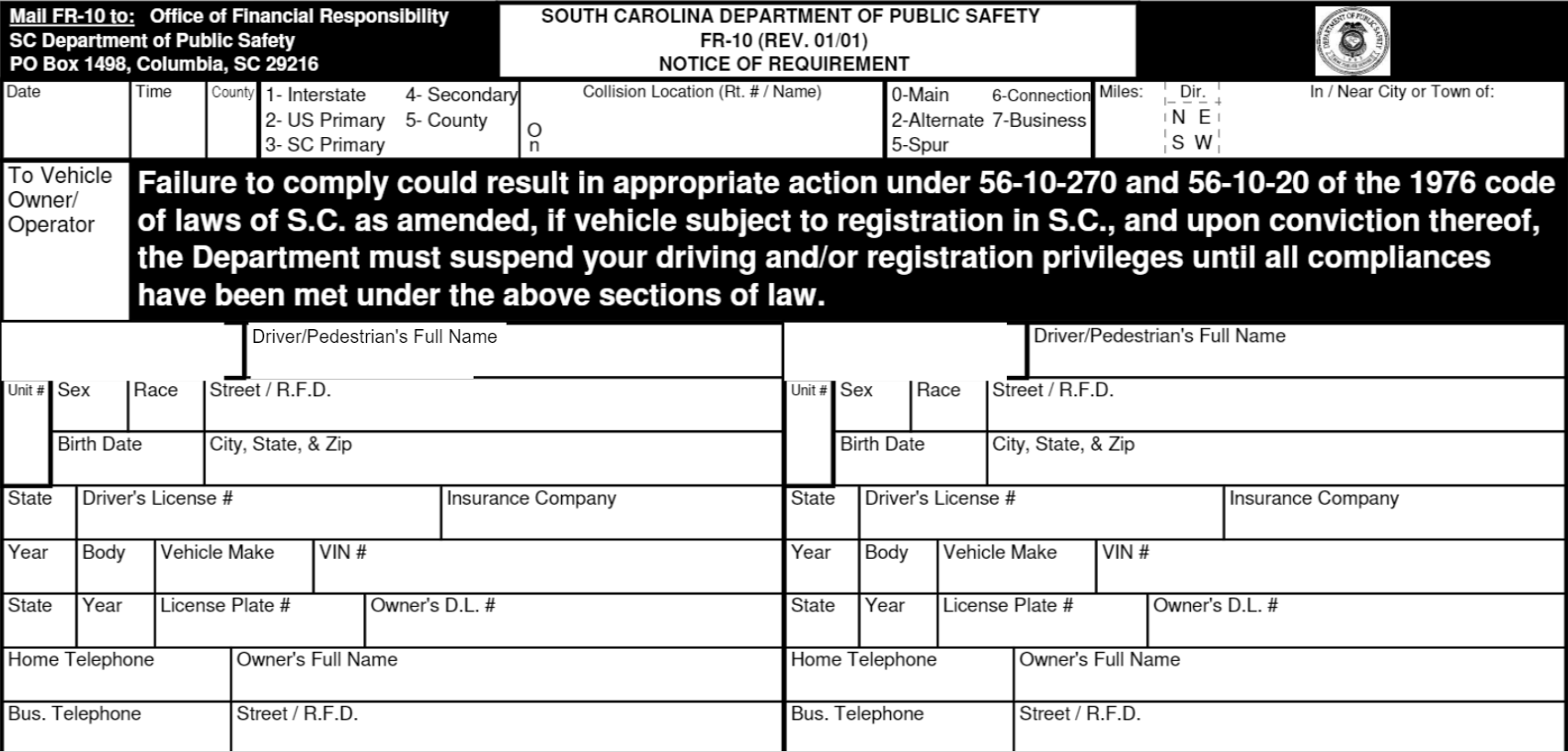

What Is An Fr 10 Form Steinberg Law Firm

South Carolina Income Tax Calculator Smartasset

2022 Property Taxes By State Report Propertyshark

Free South Carolina Sc Last Will Template Fillable Forms

Florida Vs South Carolina For Retirement Which Is Better 2020 Aging Greatly

A Gentleman S Farm On 38 Acres In South Carolina Mansion Global

How Do State And Local Property Taxes Work Tax Policy Center

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

5 Tips For Protecting Your Tax Refund From Fraudsters Sc Office Of The State Treasurer

2020 Estate Planning Update Helsell Fetterman

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition